Estée Lauder: Capitulation at Last after Q1 FY25 Results?

Company Update (EL US) (Buy): We may have reached the point of maximum pessimism, and there is “new” management with a free hand.

Highlights

Q1 results were “kitchen sink” with FY outlook withdrawn and dividend cut.

Large part of weak P&L is due to China macro also impacting EL’s peers.

Trading is poor not disastrous; new CEO likely has a free hand for turnaround.

Valuation has fallen to ~15x pre-COVID FY19 FCF; Dividend Yield now 2.2%.

With shares at $63.34, we see an 82% return (26.2% annualized) by Jun-27. Buy.

Introduction

We review our Buy rating on Estée Lauder (“EL”) after a turbulent week. EL shares fell 20.9% last Thursday (October 31) with Q1 FY25 results, and fell another 3.9% yesterday (November 6) after the U.S. presidential election.

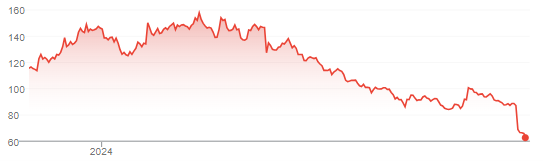

EL shares have now fallen 83% since 2021 year-end, having peaked just before that, including 45% in the past year:

EL Share Price (Last 1 Year)

Source: Google Finance (07-Nov-24).

We have been dramatically and repeatedly wrong on EL, which entered our “Select 15” model portfolio as a small position in September 2023 and was expanded into a mid-sized one in July this year. Our real-life positions mirror these in relative size but began earlier. We published our first Buy rating on Estée Lauder in April 2020.

While conscious of our mistakes so far, we feel that cyclical macro factors explain a large part of the poor Q1 FY25 results, and the stock may have now reached a point of maximum pessimism. A “new” management team has been given a reasonably free hand, and some sensible operational changes have already been made. We roughly doubled the number of EL shares just after Q1 FY25 results were released, when it was down ~26% on the day at ~$64.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)