Philip Morris: Why the Market Didn’t Like Q4 Results; We Disagree

Company Update (PM US) (Buy): The business continues to advance structurally, but non-operational headwinds mean there’s been little earnings growth. We believe this is changing.

Highlights

Q4 heated tobacco sales grew 13.9%; U.S. ZYN shipments grew 78.2%

But shares fell after results because earnings growth disappointed again

Headwinds are non-operational and temporary; EBIT growth is improving

Shares fallen 14% in the past year; 14.8x P/E, 5.8% Dividend Yield

At $89.12, we see an 100% total return (28.2% p.a.) by end of 2026

Introduction

Philip Morris (“PM”) released Q4 2023 results last Thursday (February 8); shares finished the day down 2.7% and was flattish the day after, which means the share price has now fallen 14% in the past year (partly offset by dividends):

PM Share Price (Last 1 Year)

Source: Google Finance (11-Feb-24).

We can easily fill an article with charts showing numbers in IQOS, ZYN, PM’s market share, etc., all continuing to point upwards, as PM delivered on these again. However, you can find the same charts already in company materials. Instead we will explain why some market participants may interpret PM’s financials negatively, and why we disagree.

PM has been one of our core holdings and part of our “Select 15” model portfolio since inception. Its performance in 2023 was mediocre, returning only 3.1% (including dividends) during the year, dragging its return since the start of 2021 down to just 27.3% in approximately 3 years. We believe PM’s business has continued to advance structurally, but progress has been masked by mostly one-off macro factors, and with lagging valuation the investment case has only become more attractive. (PM is our #2-ranked stock as of last month, and we bought more after results last week.)

Q4 2023 results continued this pattern, with excellent business growth being offset by non-operational headwinds.

Total Heated Tobacco Unit (“HTU”) In-Market Sales grew 13.9% year-on-year, including by 13.4% in Japan (IQOS’s first breakout market), and U.S. nicotine pouch volume grew 78.2%. PM retains a 75%+ share in each of these fast-growing categories. Prior-year inventory movements meant HTU shipments grew “only” 6.1%, but this was enough for PM’s total tobacco volume to stay relatively flat (-1.5%) and Net Revenues to grow 8.3% organically in Q4.

Full-year 2023 growth rates were similarly impressive, at 14.8% for HTU In-Market Sales, 62.0% for U.S. nicotine pouches, 1.0% (positive) for total tobacco volume and 7.8% for Net Revenues organically.

However, high inflation and supply chain disruption (mostly in H1) meant Adjusted EBIT only grew 3.7% organically, while currency and new debt for acquiring Swedish Match meant Adjusted EPS grew by only 0.4% in dollars in 2023.

2024 outlook assumes the same strong growth in HTU In-Market Sales (14-16%), volume growth of “only” 35% in U.S. nicotine pouches, Net Revenue growing 6.5-8% organically and Adjusted EBIT growing 8-9.5% organically. However, Adjusted EPS is expected to grow “only” 7-9% ex-currency and 5-7% in dollars, again due to non-operational factors.

We believe PM’s strong business growth will soon more readily lead to dollar earnings growth. Margin headwinds are moderating. Adjusted EBIT was significantly higher year-on-year in Q2 and Q3. PM is in an investment phase, especially in the U.S. Interest expense should eventually decline as PM continues deleveraging and rates fall. Management has reiterated their target for a 9-11% ex-currency EPS CAGR in 2024-26. Currency headwinds should abate eventually.

At $89.12, relative to 2023, PM shares have a P/E of 14.8x. The Dividend Yield is 5.8%. Free Cash Flow Yield is 6.7% on 2024 outlook. Including a re-rating to 21x, our forecasts indicate investors can double their money by 2026 year-end (implying a 28.2% annualized return). PM is our top pick among Tobacco stocks, and we reiterate our Buy rating.

(For a recap of our investment case, see the first Philip Morris article we published on Substack in April 2023.)

We will start by explaining how parts of PM’s Q4 and full-year results were weaker and could be viewed negatively.

Philip Morris Q4 Results Headlines

PM’s Q4 2023 results showed excellent business growth, but offset by non-operational headwinds:

PM Key Volumes & Financials (Q4 2023 vs. Prior Year)

Source: PM results release (Q4 2023).

Total HTU In-Market Sales grew 13.9% year-on-year, but HTU shipments grew “only” 6.1% because of higher prior-year inventory movements, both to replenish shortages in Japan and to prepare for ILUMA’s launch in Europe. (This is the mirror image of Q4 2022, when HTU In-Market Sales grew 20.3% year-on-year but shipments grew 26.1%.)

Importantly, Q4 HTU In-Market Sales was 13.4% higher in Japan, as category growth and PM share gain both continued in IQOS’s first breakout market. Heated tobacco is now “close to 40%” of the total nicotine market in Japan, with PM products representing 27.6 ppt of the 40%, implying an approximately 70% category share.

In Q4, IQOS’s share of the nicotine market reached 9.6% in Europe (up from 8.4% in the prior-year quarter), and it also approached exceeded 10% in key Lower- and Middle-Income cities outside Europe such as Beirut (14.3%), Kuala Lumpur (10.3%) and Cairo (9.4%), signifying IQOS’s long-term potential worldwide. Globally, IQOS has a share of “over 75%” of the heated tobacco category.

The combination of good volume growth in HTUs and a relatively small (1.9%) volume decline in cigarettes meant PM’s total tobacco shipment volume was relatively flat (-1.5%) year-on-year in Q4 2023.

In U.S. nicotine pouches, PM’s ZYN volume grew 78.2% year-on-year in Q4, and its volume share of the category rose 2 ppt sequentially to 72.8%; its value share also rose 1.5 ppt to 77.4%.

That PM retains a 75%+ share in both heated tobacco and U.S. nicotine pouches means it will continue to see strong revenue growth as smokers transition to Reduced Risk Products. (PM’s share gains is mirrored in the share losses we have observed in Altria’s Q4 2023 results and British American Tobacco’s FY23 results; BAT, in particular, complained about market share losses in “highly competitive markets in Japan and Italy”.)

PM’s Net Revenue growth in Q4 was also helped (approximately 3%) by a $250m excise tax accounting gross-up (with a corresponding $250m in Cost of Goods Sold) related to new third-party manufacturing arrangements in Indonesia.

All these help PM’s Net Revenues grew 8.3% organically year-on-year in Q4, even with the inventory impact on HTU shipments mentioned above. Including the Swedish Match acquisition (which only contributed 1.5 months in the prior year), Net Revenues grew 11.9% ex-currency and 11.0% in dollars in Q4.

However, due to $301m of currency headwinds, Adjusted EBIT only grew 2.6% in Q4, and Adjusted EPS fell 2.2%. (Adjusted EBIT Margin fell nearly 3 ppt year-on-year, but partly due to the excise tax gross-up mentioned; management stated that “Q4 margins were broadly stable organically, and grew excluding the technical effects mentioned”.)

Philip Morris 2023 Results Headlines

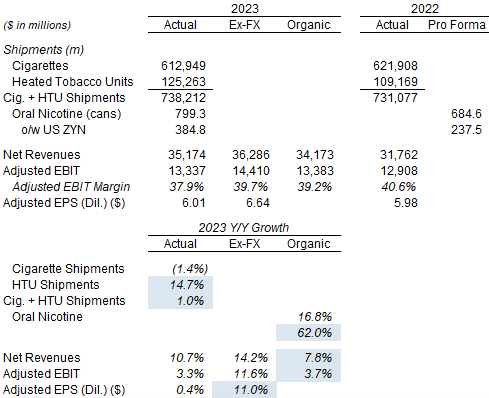

Full-year growth rates were similarly impressive, at 14.7% for HTU shipments (14.8% for HTU In-Market Sales), 62.0% for U.S. nicotine pouches, 1.0% (positive) for total tobacco volume and 7.8% for Net Revenues organically:

PM Key Volumes & Financials (2023 vs. Prior Year)

Source: PM results release (Q4 2023).

However, Adjusted EBIT only grew 3.7% organically in 2023, after Adjusted EBIT Margin fell from 40.6% in the prior year to 39.2% organically and 37.9% as reported in dollars. As discussed in our reviews of previous results (of Q1, Q2 and Q3 2023 respectively), high inflation and supply chain disruption became global phenomena in 2022, with the latter driving obviously one-off measures like the use of air freight to transport IQOS products to Japan.

Currency was a large headwind to the bottom line, reducing Adjusted EBIT growth by more than 8 ppt ($1.07bn) and Adjusted EPS growth by more than 11 ppt in 2023. The headwind came from both Emerging Markets and Developed Markets currencies, with impact on Adjusted EBIT consisting of:

5 ppt from “South & South East Asia, CIS & Middle East Africa” (particularly Egypt and Russia)

3 ppt from “East Asia, Australia & Duty Free” (mostly Japan)

1.5 ppt from Americas (particularly Argentina)

These are offset by 1.5 ppt of tailwind from Europe, mostly the Eurozone (offset by a headwind from the Swiss franc).

Higher interest expense was another headwind, responsible for Adjusted EPS growth lagging Adjusted EBIT growth by about 3 ppt. Interest expense increased by $473m (80%) in 2023, or about 4% of 2022 Adjusted EBIT, due to new debt for acquiring Swedish Match (which took place in Q4 2022 but only started to impact the full year in 2023.)

As a result of all these non-operational headwinds, Adjusted EPS grew by just 0.5% in dollars in 2023, from $5.98 to $6.01. This low growth, while long expected, likely explains much of the weakness in PM’s share price in the past year.

Philip Morris 2024 Outlook

The new 2024 outlook assumes the same strong business growth but some similar non-operational headwinds:

PM 2024 Outlook

Source: PM results presentation (Q4 2023).

The outlook in HTU In-Market Sales (14-16%) is in line with actual performance in 2023 (14.8%), while the outlook for U.S. ZYN shipment volume implies a slightly lower growth number (135m cans vs. 147m) and a much lower growth percentage (35% vs. 62%) owing to a larger base. However, CEO Jacek Olczak described the latter as “a matter of prudence” and hinted it could be raised in future (“we build the confidence as you go through the year”).

The outlook includes a 2bn headwind to HTU volume in Europe (equivalent to 4% of the region’s HTU volume, or 1.6% of PM’s global HTU volume in 2022) as a result of the European Union’s ban on flavors in heated tobacco and related regulations being gradually implemented across the bloc. Management stated they estimate “only a small impact” on consumer offtake and trade inventory in the 11 E.U. markets that have already implemented the changes since October.

Net Revenue is guided to grow 6.5-8% organically and Adjusted EBIT to grow 8-9.5% organically in 2024, both within the 2024-26 CAGR target ranges set out at the investor day last November:

PM Medium-Term Targets (2024-26)

Source: PM investor day (Sep-23).

However, 2024 outlook of a 7-9% Adjusted EPS growth (ex-currency) is below the medium-term target range (of 9-11%). The culprits again include higher interest expense, which management expects to rise further from $1.06bn in 2023 to $1.3-1.4bn in 2024 (representing a 2% headwind to Net Income in our estimate), as well as a higher tax rate (stemming from Russia suspending certain double-taxation treaties).

Including a currency headwind of $0.11, 2024 Adjusted EPS outlook is $6.32-6.44, implying growth of just 5-7%. We believe this disappointed some investors and was a key reason for the shares’ decline after Q4 results were released.

Profit Growth Led by Smoke-Free & Europe

PM’s earnings growth in 2023 was largely driven by smoke-free products (IQOS and ZYN), where Gross Profit grew 19.2% organically (to reach “over 40%” of the group), in contrast with the stagnation (+0.3%) in Combustibles:

PM Organic Growth – Smoke-Free vs. Combustibles (FY23)

Source: PM results presentation (Q4 2023).

CFO Emmanuel Babeau described the challenges in Combustibles on the call:

“Despite very strong pricing there was only marginal organic growth in combustible gross profits. This partly reflects the negative geographic mix I already mentioned, with greater volume declines in higher margin markets like Japan as adult smokers switch to smoke-free products, and better volume trends in lower margin geographies where smoke-free products are small or not available such as Turkey. There were also significant inflationary pressures on leaf, direct materials and other manufacturing costs.”

In Adjusted EBIT, Europe had the largest organic growth rate in Q4 and generated substantially all of the dollar growth:

PM Net Revenues & Adjusted EBIT by Region (Q4 2023 vs. Prior Year)

Source: PM results release (Q4 2023).

Europe’s outsized contribution in Q4 was in part due to inventory moves in Japan, where In-Market Sales grew 13.4% but shipments fell 13.3%, which depressed the P&L in “East Asia, Australia & Duty Free”. (The region’s Adjusted EBIT grew 37.8% organically in Q1-3, or 20.4% in dollars.) However, it also reflects a relatively benign market in Europe at present, with the total market for cigarettes and HTUs growing 0.9% in Q4 and falling just 1.3% for the full year (including declines of only 2.6% in Q4 and 3.0% for the full year in cigarettes).

Strong Earnings Growth to Materialise in 2024

We believe Philp Morris’ strong business growth will soon more readily lead to dollar earnings growth.

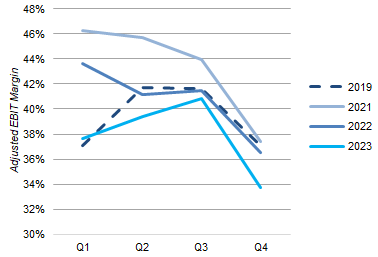

Margin headwinds are moderating. The deceleration in inflation worldwide, once the after-shocks of Russia’s invasion of Ukraine in February 2022 have been lapped, is well-known. PM has benefited from this, though the multi-year nature of its tobacco crop inventory and hedges mean both negative and positive impact on its P&L lag. Quantitatively, we can observe that PM’s Adjusted EBIT Margin fell less year-on-year through each quarter of 2023, until it was distorted in Q4 by the excise tax gross-up mentioned above and other technical factors (otherwise it was “broadly stable organically”):

PM Adjusted EBIT Margin by Quarter (2019, 2021-23)

Source: PM results releases.

2024 outlook, with Adjusted EBIT growth (8-9.5% ex-currency) exceeding Net Revenue growth (6.5-8%), reflects expectations of margin rising year-on-year. CFO Emmanuel Babeau stated on the call this will be visible in Q1:

“We forecast a strong Q1 overall … We expect organic top-line and OI growth to be broadly consistent with the full year outlook, which implies organic margin expansion as with the full year.”

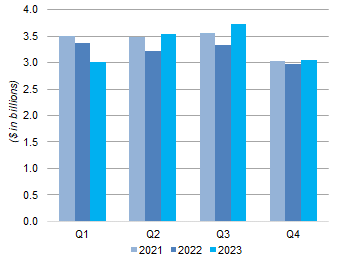

In fact, Adjusted EBIT was significantly higher year-on-year in Q2 and Q3, and for H2 as a whole:

PM Adjusted EBIT Dollars by Quarter (2021-23)

Source: PM results releases.

While the increase was helped by the acquisition of Swedish Match, organic Adjusted EBIT growth also progressively improved from -10.7% in Q1 to +6.9% in Q2 and +11.3% in Q3 (but +8.0% in Q4). And the higher Adjusted EBIT should have been reflected in a higher PM share price, which has actually fallen in the past year.

Philip Morris in Investment Phrase

When interpreting PM earnings, investors should bear in mind the company in an investment phase.

IQOS continues to be rolled out across the world, including U.S. launch in May 2024 for which PM has been preparing. PM has also progressively been replacing its old blade-based device with the new induction-based ILUMA since H2 2021 (a process that was “substantially complete” as of Q4), which necessitated more marketing spend as well as higher initial manufacturing costs. The roll-out of ZYN in the U.S. has been stepped up, and PM has also launched/relaunched it in 10 other markets during 2023. The acquisition of Swedish Match in 2022 was effectively a Leveraged Buyout funded by debt. The costs of all these are burdening the P&L but should disappear over time (even if unsuccessful).

The temporarily slower dollar earnings growth and weak share price represent an opportunity for long-term investors.

Deleveraging, Interest Rates & Currency

Interest expense should eventually decline as PM continues deleveraging and rates fall.

Management targets a reduction of 0.3-0.5x in its Net Debt / EBITDA in 2024 (from 3.16x at year-end), though PM still expects the year’s interest expense to be higher. The weighted maturity of PM’s long-term debt was 7 years at the end of 2023, with $4.71bn maturing in 2024 and $6.79bn in 2025 – some oft these may have to be financed at higher rates, even if/when interest rates start to fall in 2024. PM does have $1.97bn of commercial paper and bank loans (out of $47.9bn of total debt), which will benefit more quicky from any rate cuts.

Currency headwinds should abate eventually. The Developed Markets portion of PM earnings has been growing, thanks to the success of IQOS in more advanced economies and ZYN in the U.S. As of Q4 2023, 53% of PM’s Adjusted EBIT was generated in its Europe region (the Euro was 29% of group revenues in 2022, before Swedish Match), another 11% came from Swedish Match (mostly the U.S. and Nordic), and Japan contributed 11% of revenues in 2023.

Philip Morris Valuation

At $89.12, relative to 2023 financials, PM shares have a 14.8x P/E and a 5.6% Free Cash Flow (“FCF”) Yield:

PM Net Income, Cashflow & Valuation (2021-24E)

Source: PM company filings.

Relative to the 2024 outlook, the P/E is 14.0x at mid-point and the FCF Yield is 6.7%. FCF was atypically low in 2023, due to both higher CapEx and a large cash outflow for working capital (including $862m for inventories).

Note that our valuation metrics now include the earnings contribution from Russia, in line with how PM presents its figures. Management stated in September 2023 that Russia represented only 6-7% of their EPS; we believe the percentage is continuing to shrink, given how PM has suspended new investments there and local market conditions.

The Dividend Yield is 5.8%, with a quarterly dividend of $1.30 ($5.20 annualized), previously raised by 2.4% last September. Management has reiterated PM’s commitment to the dividend as “unwavering”.

Share repurchases have been suspended after the Swedish Match acquisition; we expect to these to resume by 2026. Net Debt / EBITDA was 3.16x in December, down from 3.24x in June.

Philip Morris Stock Forecasts

To present our figures in line with management’s version, we no longer exclude the estimated contribution from Russia in our forecasts, but we have reduced our exit P/E assumption by 1x to 21.0x to reflect this.

We use the mid-point of the new 2024 EPS outlook, but leave other assumptions unchanged.

Our assumptions are now:

2024 EPS of $6.38 (was $6.20 when Russia was excluded)

Net Income to grow at 10% annually in 2025-26 (unchanged)

Share count to be flat (unchanged)

Dividends to grow at 2% annually (unchanged)

P/E at 21.0x at 2026 year-end (was 22.0x)

Our new 2026 EPS forecast is $7.72 (was $7.51 when Russia was excluded):

Illustrative PM Return Forecasts

Source: Librarian Capital estimates.

Our new 2026 year-end exit price is $162, 2% lower than before ($165).

With shares at $89.12, our forecasts indicate investors can double their money by 2026 year-end (implying a 28.2% annualized return).

Philip Morris is our top pick among Tobacco stocks, and we reiterate our Buy rating.

Ends

Stocks mentioned: PM 0.00%↑ MO 0.00%↑ BTI 0.00%↑. We are long PM and BAT.

Disclaimer: This article consists of personal opinions, based on information believed to be correct at the time of writing, but not guaranteed. We undertake no responsibility in updating content in this article. Nothing published here should be taken as financial advice.