Alphabet: Strong Q2 Headlines, But Too Many Moving Parts?

Company Update (GOOG US) (Buy): 8%+ decline in shares since results likely reflects fears of ad revenues slowing, headcount rising and SearchGPT. We disagree.

Highlights

Revenues grew 13.6% in Q2, with strong Search and YouTube Ads.

EBIT growth exceeded 20% even after excluding one-offs.

But ad revenue may slow, headcount will rise, SearchGPT just launched.

Alphabet has the advantages to win, shares are on 28.6x 2023 EPS.

At $168.68, we see return of 85% (19.8% p.a.) by end of 2027. Buy.

Introduction

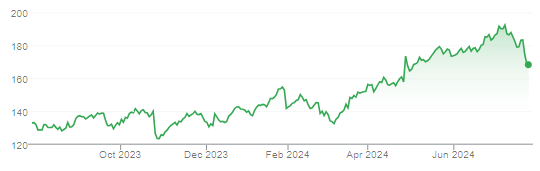

We review Alphabet after Q2 2024 results were released following market close last Tuesday (July 23). Alphabet (Class C) shares fell 5.0% the day after results and fell again in the subsequent days two, to a total decline of an 8.1%:

Alphabet Class C Share Price (Last 5 Years)

Source: Google Finance (28-Jul-24).

OpenAI also announced the initial launch of its new SearchGPT search engine last Thursday (July 25).

We initiated our Buy rating on Alphabet in January 2021 and have included it in our “Select 15” model portfolio since its inception at the start of 2023; Alphabet is also one of our largest holdings in real life. At their latest price, Alphabet shares have gained 77.8% in the 3.5 years since our initiation, including 17.0% since our last article in January.

We believe Q2 results again showed the strength of the growth drivers behind Alphabet’s businesses, despite Search supposedly being disrupted by AI. Investors likely over-reacted to the number of moving parts, including a potential ad revenue “slowdown” in Q3 and the return of headcount growth. Alphabet’s high Capital Expenditure remains controversial, but we believe it will pay off and is at worst a non-repeating “sunk cost”.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)