Otis: Don't Over-react to Double-Digit Order Declines in Q2

Company Update (OTIS US) (Buy): Shares fell 7.1% after Q2 results; we believe some investors over-estimated the impact of cyclical headwinds.

Highlights

New Equipment orders fell double-digits in China and the Americas, again

Adjusted EBIT still grew 6.4% organically in Q2; 2024 outlook was unchanged.

Repair growth was cyclically weaker, but Maintenance base again grew 4.2%.

Otis shares are at 25.2x 2023 EPS and have a 1.7% Dividend Yield.

With shares at $91.43, we see a 65% total return by 2027 (16.2% p.a.). Buy.

Introduction

We review our Buy rating on Otis after shares fell 7.1% yesterday (July 24), following the release of Q2 2024 results.

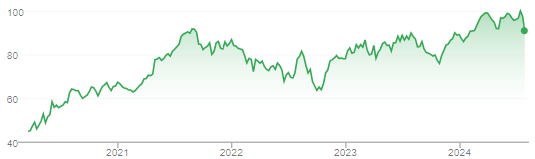

We initiated our Buy rating on Otis (at $56.50) in July 2020, and have included it in our “Select 15” model portfolio since inception, increasing it to a mid-sized position in January (at $88.01). Even with yesterday’s decline (to $91.43), Otis shares have gained 69.7% (including dividends) in the 4 years since our initiation:

Otis Share Price (Last 5 Years)

Source: Google Finance (25-Jul-24).

Otis is a mid-sized position for us in real life, and we added moderately to our holding after results yesterday.

We believe Otis shares continue to be attractive, and investors have over-reacted to the cyclical elements of its operational performance because they have over-estimated their earnings impact. The structural drivers of the investment case are intact, and our updated forecasts indicate a mid-teens annualized return by 2027 year-end.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)