Microsoft: Solid Growth in Q2 FY25; Flattish Shares from A Year Ago

Company Update (MSFT US) (Buy): Revenues grew 31% in Azure, 21% in Cloud and 16% in the two enterprise-focused segments; P/E now 33.4x.

Highlights

Revenue, EBIT and Net Income all grew 10%+ in Q2 FY25.

FY outlook includes double-digit EBIT growth, but also Q3 dip.

CapEx growth will moderate in FY26; DeepSeek is a positive.

Trailing P/E of 33.4x is cheap for such a high-quality asset.

At $414.99, we see 62% upside (15.6% p.a.) by June 2028. Buy.

Introduction

We review our Buy rating on Microsoft following Q2 FY25 (October-December) results released after market close on Wednesday (January 29); shares fell ~6% on the day after, just as they did following Q1 FY25 results last November.

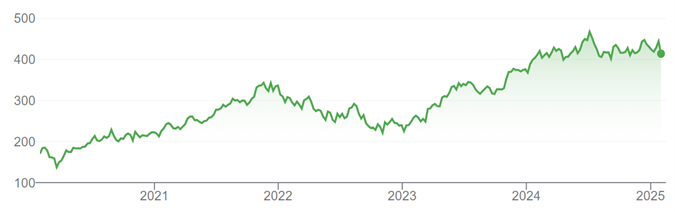

Microsoft shares are now just 4% higher than a year ago, though still up 144% over the past 5 years:

MSFT Share Price (Last 5 Years)

Source: Google Finance (30-Jan-25).

Microsoft has been a top-5 position in our “Select 15” model portfolio since its inception at the start of 2023, and we first published our research on Microsoft online with a Buy rating in December 2020. We have also held Microsoft shares continuously in real life since 2014, having first bought at ~$37. We added moderately to our position yesterday.

The momentum in Microsoft’s businesses has continued in Q2 FY25, its trailing P/E has fallen back to 33.4x as double-digit EPS growth continues, and cheaper AI computing capacity (as heralded by DeepSeek) is a positive for the stock.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)