Librarian Capital's Monthly Ranked Top Buys - December 2024

Portfolio Strategy: Our "Select 15" portfolio is currently up 41.7% since the start of 2023, and we have our first double-bagger.

Introduction

We continue our "Monthly Ranked Top Buys“ series, intended to present a model portfolio to showcase our most-preferred stocks and to quantify our view of each stock’s relative attractiveness. We call this portfolio “Select 15”, and it closely resembles how we manage capital in real life, including more than 80% of our personal assets.

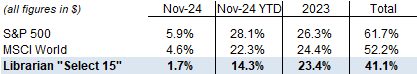

“Select 15” gained 1.7% in November, taking our year-to-date total gain to 14.3% as of the end of November:

The portfolio has regained a further 0.5% during December 1-23. As of December 23, our model portfolio has gained 41.7% since its inception. Beginning with a notional $1m at the start of 2023, it has risen to $1.42m after ~2 years:

With less than a week to go, the “Select 15” model portfolio is currently up 14.9% for 2024, after a gain of 23.4% in 2023. As before, our returns are good in absolute terms, but behind the MSCI World (our benchmark) in relative terms. We have been relatively defensive, and have stay focused on quality businesses we understand. Consequently, we have had no exposure to the meteoric rises of names like Nvidia (up ~190% YTD), Constellation Energy (up ~95%) and Telsa (up ~80%); however, we also expect our portfolio to be more resilient if/when equity markets start to reverse.

For investors who are U.K.-based like ourselves, that our portfolio has gained 41.7% (in U.S. Dollars) since the start of 2023 means we have made more money in just under two years than what most U.K.-focused funds have made in five, despite the Pound gaining ~5.5% against the Dollar in this period. (In the past 5 years, the FTSE All-Share has gained ~32% in Pounds, while “IA UK All Companies”, i.e. the average U.K.-focused fund manager, has gained ~22%; FTSE SmallCap has gained ~42%.) Asset class selection can be as important as individual stockpicking to returns.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)