Librarian Capital's Monthly Ranked Top Buys - June 2024

Portfolio Strategy: Our "Select 15" portfolio has now gained 35.1% since the start of 2023. We review portfolio news and replace one holding with a new position.

Introduction

This is the June edition of our "Monthly Ranked Top Buys“ series, intended to present a model portfolio to showcase our most-preferred stocks and to quantify our view of each stock’s relative attractiveness. We call this portfolio “Select 15”, and it closely resembles how we manage capital in real life, including more than 80% of our personal assets.

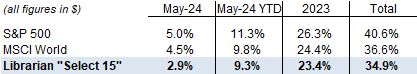

“Select 15” gained 2.9% in May, taking our year-to-date gain to 9.3% and since-inception gain to 34.9%:

Equity markets were up in May, and we gained 1.6 ppt less than MSCI World, a mirror image to the “down” market in April when we lost 2.3 ppt less than the benchmark. Our portfolio has been less volatile than the index in recent months, despite its higher concentration, which we can attribute to the relatively defensive nature of our holdings.

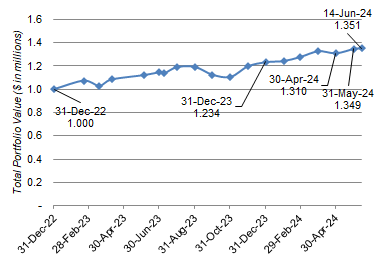

At the time of writing, the portfolio has gained a further 0.2% in June 1-14, taking our gains to 35.1% since inception. Beginning with a notional $1m at the start of 2023, it is now worth $1.351m after just under 1.5 years:

Compared to the end of April, as of 14 June, the largest share price increases among our holdings were in Microsoft (+13.7%), Alphabet (Class A) (+8.6%) and Philip Morris (+7.6%), our largest 3 positions, while the largest prices decreases were in Estée Lauder (-22.4%), PayPal (-10.7%) and Diageo (-7.1% in GBP), which are smaller positions.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)