Librarian Capital's Monthly Ranked Top Buys - August/September 2024

Portfolio Strategy: Our "Select 15" portfolio has now gained 40.0% since the start of 2023. We replace one holding and resize others.

Introduction

We continue our "Monthly Ranked Top Buys“ series, intended to present a model portfolio to showcase our most-preferred stocks and to quantify our view of each stock’s relative attractiveness. We call this portfolio “Select 15”, and it closely resembles how we manage capital in real life, including more than 80% of our personal assets. This is the combined edition for both August and September, since workloads and holidays meant we did not publish last month.

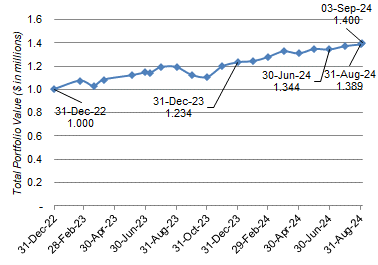

“Select 15” gained 2.2% in July and 1.1% in August, taking our year-to-date total gain to 12.6% as of the end of August:

The portfolio gained a further 0.8% during September 1-3. As of September 3, our model portfolio has gained 40.0% since its inception. Beginning with a notional $1m at the start of 2023, it is now worth $1.40m after less than 2 years:

Our returns are satisfactory in absolute terms, but behind the MSCI World in relative terms. We believe our returns have been achieved with much better risk/reward than the benchmark – among our top 10 winners to date (by dollar value), three are members of the Magnificent 7, but the other seven are from a diversified set of industries including insurance, consumer staples and aerospace/defence. More importantly, they are all high-quality businesses that will continue to generate shareholder value for years to come. We believe we will outperform the MSCI World over time.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)