Librarian Capital's Monthly Letter - May 2025

Portfolio Strategy: We review our macro positioning after the market rebound since May, and replace one stock in our model portfolio.

Introduction

This “Librarian Capital’s Monthly Letter” is a continuation of our "Monthly Ranked Top Buys“ series. It discusses key market developments and corporate news each month, and also tracks our “Select 15” model portfolio. The latter is a way to showcase our most-preferred stocks and quantify our view of the relative attractiveness of each, and closely resembles how we manage capital (including more than 80% of my personal assets) in real life.

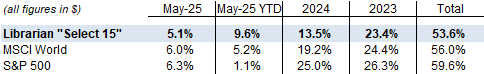

“Select 15” gained 5.1% in May, 0.9 ppt less than MSCI World, our benchmark, breaking a 5-month streak of outperformance from December; year-to-date, it had gained 9.6% as of May month-end, 4.4 ppt ahead of MSCI World:

“Select 15” has been flattish during June 1-26. Beginning with a notional $1m, it has risen to $1.54m after ~2.5 years:

Global indices have rebounded since the end of April, and are once again at or near all-time highs. We are more pessimistic than the market and more defensively positioned, so we have benefited from the rebound but not by as much. We do not believe the current level of optimism can last, especially once companies start reporting Q2 results.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)