Fundsmith: 2024 AGM Full Transcript

Full transcript of the Fundsmith AGM, including the hour-long Q&A session.

This is a full transcript of the Fundsmith AGM held in February 2024, including the hour-long Q&A session.

Presenting: Terry Smith (CEO & CIO), Julian Robins (Head of Research), Ian King (Moderator)

Table of Contents

Moderator Introduction

Fundsmith Introduction

2023 Performance Recap

2023 Contributors & Detractors

Under-Performance & “The Magnificent Seven”

Would You Own This Stock?

Under-Performance & Sector Bias

Investment Strategy

Only Invest in Good Companies

Don't Overpay

Do Nothing

Q&A Session

Impact of Potential 2nd Trump Term

Fundsmith’s Investable Universe

Is Being Fully-Invested a Drag on Returns?

U.K. Stocks that Fundsmith Likes

Are U.K. Stocks Undervalued?

Why Terry Smith Dislikes U.K. Banks’ ROTE

On Standard Chartered’s “Crap” P/E

What Went Wrong in Sale Decisions

What is Fundsmith’s Comfort Zone?

A Bank that Terry Smith Likes

Selling Your Own Children

Consumer Staples Not As Good As Before

Fundsmith’s Views on AI

Taking Another Kick at Unilever

Other Consumer Companies Exited

Private Labels Threat to Consumer Staples

Fundsmith Holdings with Most Upside Potential

Why Fundsmith Ended Up Not Buying Adyen

Who’s Fundsmith’s Charlie Munger?

Moderator Introduction

King: Good evening, ladies and gentlemen, and welcome to the annual Fundsmith shareholder meeting. It’s good to see so many of you here. I think we are even up on last year’s attendance.

For those of you that don’t know, my name is Ian King. I am the business presenter at Sky News. And joining me, of course, two gentlemen, who need absolutely no introduction, Julian Robins and, of course, Terry Smith.

Now the format is pretty similar to last year, you write in with your questions for Terry and Julian, and the Fundsmith people then very hopefully put them into a big long list for me to look at, and then I decide which ones we are going to put to Terry and Julian on the night. So, if your question doesn’t get asked, don’t blame them, you can blame me.

The good news is, if your question isn’t answered this evening, Fundsmith will get in touch with you, your question will be answered, it just won’t be on this platform necessarily. But everyone who has written in with a question will get an answer.

And I should also just remind you, my interests are very much aligned with yours, I have money with Fundsmith, and so do all of my children. They have some of their long-term savings tied up with Fundsmith as well. So my interests are very much aligned with yours. I am just as eager to know what Terry and Julian have to say to your questions as you are.

Without further ado, then, let’s crack on, and let me handover to Terry.

(Terry Smith was speaking from this point on, until the start of the Q&A session.)

Fundsmith Introduction

Good evening everybody, it’s nice to see so many of you here again. Obviously we made it back from COVID, after I managed to catch it on one occasion a while back. But it’s good to see you in person, really.

I am going to do the usual run-through. Don’t expect me to say anything that you don’t really already know, because that’s the whole point in many respects. We hope we communicate to you what we do and what we’ve done well enough for you to be able to stand up here and do this if you want.

And I will spend a bit more time on performance than I usually do, because I want to go through some background on that, because I think that is quite important, and then we are going to hand back to Ian to bowl the questions at us, okay.

There’s the disclaimer, as you know. You should read it, our regulator requires you to see it. As you know, I always paraphrase it, if you’ve been here before, basically it says if you trust me and buy the fund, it’s your problem, not mine.

2023 Performance Recap

As I said, I am going to talk a bit about performance, a few slides on performance, and then I am gong to go through the investment strategy. Again, you know the strategy by now, I hope, we‘ve made it quite clear from the outside, what it is, but really we tell you about the strategy, so you can judge whether or not we are still keeping to it. One of the dangers of fund managers is so-called style-drift, they go off and so something else, when it seems to suit them, and you can judge whether or not we are doing that when you see that.

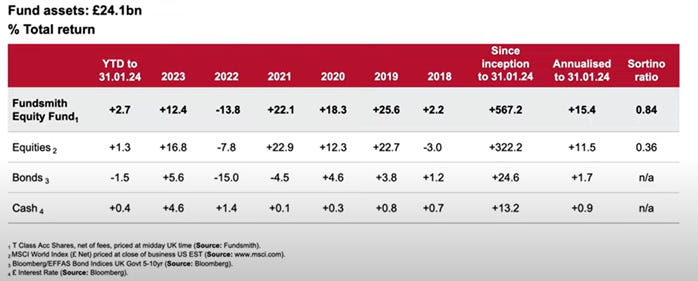

Performance, there’s performance. You will see that last year we returned 12.4%, there it is:

The market, which is the MSCI in Sterling, the dividends are re-invested, 16.8%. So we underperformed about 4%. But you made some money, which is nice, better than the previous year. And there’s January in there, 2.7% up, and I think February, we are up about another 5%, or something like that to date.

More importantly is, I think, there’s our long-term performance. I know some of you, like me, have shared in that, which is good. That’s what we do have our eyes on. We don’t have it on a particular year, or years even. We look at the long-term performance.

And this is a thing we call the Sortino ratio over here, which basically measures how much return you get for how much volatility there is in the unit price, basically. So it’s a measure, to some degree at least, of how much risk is being taken to attain the returns, because you can see some people who get great returns, but the degree of movement is considerably greater than we’ve had. And that can have some adverse effects in terms of your decision-making, and ours, and how you will feel about it.

You will see it compared with the market, over the period since we’ve been going, we have outperformed it by about 4% during the period. And the Sortino ratio, this measure of risk-adjusted return, is about twice what the market’s produced. Kind of what we are aiming for, I suppose.

The only other thing to remark about here is, last year, bonds delivered a pretty decent return. You know, you have to bear in mind, when you are investing now, whether you are investing with us or anybody else, that Uncle Sam will give you 5% without any risk whatsoever. That’s quite a high bar for anybody to jump over in terms of a return. And if you look at how funds have been selling in the last year, or year and a half, something like that, the biggest-selling funds are short-term funds in fixed income, because that’s a decent return.

2023 Contributors & Detractors

What worked and what didn’t. So the top 5 performers and the top 5 detractors:

We show those to see what we can learn.

Our biggest performer last year was Meta Platforms, the old Facebook. And, if you have read the annual letter, I say there, only half-jokingly, I am thinking of starting a new fund, which each year will only own one share; it will be a different share each year, it will rotate to a new share each year, and the sole criterion for that one will be the one we get the most criticism for owning. We got a barrage of criticism over the Facebook holding, and there it is.

Microsoft, second best performer. You can say much the same about Microsoft. If we look back to our annual meeting for the year when we bought it, and the questions and comments, there’s a lot of criticism of us buying Microsoft at about $25 or $26, which is a long way short of where it is now, which is $400 and something, I can’t remember which, Julian knows these things better than me. A more important point is, this is the 8th time that I’ve shown Microsoft in the largest contributors.

And, the way I usually express it is, you make money with old friends. If you’ve got something big like that that you get right, the likelihood is it’s going to continue to be right. I am not a gardener, but I am told that what you are supposed to do, is water the flowers and pull up the weeds. And awful lot of people do it the other way round. They sell the things that worked, and hang on to the things which are not working in the hope they will come right. Our strategy, and I think, in my view, may be the correct way to do it, is the opposite of that, to run our big winners.

Novo Nordisk, if you hadn’t heard of them a year or so ago, I bet you’ve heard of them now. This is the company which is the world’s leader in the treatment of diabetes, which came out with the first effective drug, Wegovy or Ozempic, depending on what the label is on it, which is currently taking the world by storm, not just in diabetes and weight loss, but also its efficacy for other co-morbidities, so to speak, which is, it’s now got labels for cardiovascular, it’s going get labels, I think, for treatment of kidney, liver, probably arresting Alzheimer's, auto-immune conditions like arthritis, lupus, etc., and so on. And that’s actually making its 4th appearance in this table, to give you that theme again. We owned Novo Nordisk long before the words “weight loss” were ever associated with it. What really attracted us was the company’s approach to drug discovery.

L'Oréal, one of our favourite stocks as you know, if you’ve listened to us before. This is its 2nd appearance in this table.

IDEXX Laboratories, lastly, this is the leading manufacturer of veterinary diagnostic equipment and supplies in the world, and that’s making its 5th appearance in this table, so I think you get a theme here.

What didn’t work?

Estée Lauder, ironically, when you think L’Oréal was one of our best performers and Estée Lauder was one of our worst. Estée Lauder ran into a problem with, having completely mis-judged the China re-opening and the retail, re-opening in travel, and, as a result, had a $500 million stock write-off, which was quite bad, but, more importantly we think, exposed the real weaknesses in the supply chain that they had, and also some weaknesses in their management. And so, as a result, we actually sold it in the middle of last year. So, one of … it was our worst performer, but it was gone in the middle of the year, actually. And we don’t think we will probably own it again, unless or until there’s a change in the fundamental management of the business.

McCormick, largest manufacturer and supplier of spices and condiments in the world. They’ve got 2 businesses essentially, one supplies retail, stuff that we buy for cooking at home, and one supplies food service, so restaurants, particularly quick service, fast food, casual dining restaurants. What that split of business, they had a very good time during the pandemic, with cooking at home, very bad time with restaurants, and of course that’s now reversed. And the restaurant business, food service business, is smaller than the home retail business. So the home retail business is now coming off, as a lot of businesses are, some very strong pandemic performance, And there’s not enough in the food service business to compensate for that slight drag.

Also, the food price inflation, the input inflation, has left this company with gross profit margins about three a bit points, 3.3 points, lower than they were before the inflation. They haven’t yet manged to catch up. And again, it seems to us this is at least partly, only partly, a systems thing, their techniques for getting the price up to their customers, supermarkets, don’t react quickly enough. So a little bit of concern about that.

You will see there are 2 drinks companies here, Diageo and Brown-Forman, in these detractors. The drinks companies generally are coming off a high during the pandemic, when some people thought that people not going into work would lead people to drink less; in fact, they drank quite a lot more. I am not the least bit surprised by that. That’s obviously a high they are coming off.

Diageo has also run into a particular problem, the downturn in demand in Latin America seems to have caught them by surprise as to how much stock there was in their supply chain, between them and the consumers and distributors and retail and bars and so on. So we are a bit disappointed by their control of their supply chain into distribution in there. Brown-Forman is affected by the same pandemic highs in drinking and coming off it, but there are no operational problems in it.

(You have read 10% of this transcript; the other 90%, as listed in the Table of Contents above, is only for paid subscribers, who can also access our notes on Fundsmith’s AGMs in 2023 and 2022, as well as our growing research archive covering dozens of companies since 2023.)