Diageo: Profit Warning, Mid-Term Outlook Cut, Return to 2018 Levels; Time To Buy

Company Update (DGE LN) (Buy)

Highlights

LATAM & Caribbean sales “materially weaker” than expected

Medium-term Adjusted EBIT growth now to be 5-7% (was 6-9%)

Post-COVID normalization & elevated inflation are both factors

Diageo is a strong franchise; stock is cheap at 20x FY19 EPS

We see 64% total return (20.4% p.a.) by June 2026. Buy

Introduction

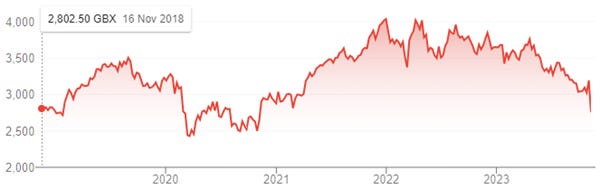

Diageo released a profit warning this morning (Friday, November 10). Shares are down 14% in London as of 2:30 pm local time, which means they are at their lowest level since 2020 and flat compared to 5 years ago:

Diageo Share Price (Last 5 Years)

Source: Google Finance (10-Nov-23).

We have had a Buy rating on Diageo since July 2019, and it was part of our “Select 15” model portfolio at inception at the start of 2023. We were too early – the share price has fallen by 23% in U.K. pounds year-to-date – but we are confident in the long-term investment case and have added significantly to our position this morning. (For a recap of our Diageo investment case, see the Substack article we…