Brown-Forman: Near 52-Week Low After Q3 FY24 Results, But Positive Sector Read-Across

Company Update (BF/A US, BF/B US) (Neutral): Depletion data and management comments indicate this is a limited and temporary market downturn.

(Note: It only takes $10 to upgrade your subscription to the paid tier, which includes access to an archive of research reports covering dozens of companies since 2023.)

Highlights

Shares have fallen 10%+ in 3 days, now just 3.5% above 52-week low.

But sales were down only 2%, even with shipments distorted by one-offs.

Depletions implied ~4% value growth; downtrading/promotions were limited.

We see EPS growth returning to mid- to high-single digits in the next few years.

But valuation is too high; at $54.42, P/E is ~29x and Dividend Yield is 1.6%.

Introduction

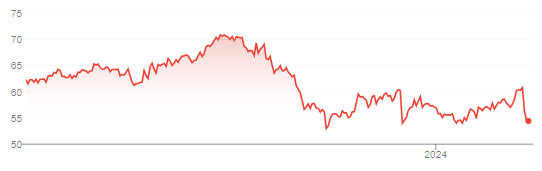

Brown-Forman released Q3 FY24 results on Wednesday (March 8). Class B shares fell 7.3% that day and are now down a total of 10.5% over 3 days, which means they are currently just 3.5% above their 52-week low:

Brown-Forman Class B Share Price (Last 1 Year)

Source: Google Finance (09-Mar-24).

We first published our research on Brown-Forman with a Neutral rating in March 2023, suggesting its stock should be avoided. Since then Brown-Forman Class B shares have lost 11.8% even after dividends. We are bullish about the Spirits sector in general, but prefer our exposure through Diageo, which is currently part of our “Select 15” model portfolio. (We are also Buy-rated on Pernod Ricard and published an update on the company last month.)

We believe Brown-Forman’s Q3 FY24 results were reasonable, but still see the valuation as too expensive. Investors were likely disappointed by the cut in FY24 outlook, with sales now expected to be flat organically, but this follows two years of double-digit growth. Year-to-date, sales were flat, but shipments were distorted by a number of one-offs including prior-year restocking and distribution model changes; depletion volumes actually imply a ~4% growth in value.

Management has observed a weakening in consumer demand, notably in the run-up to the holiday season, but largely explainable by the past two years of strong growth and recent macro headwinds. There was little downtrading or promotional pricing in Brown-Forman’s markets. All signs point to a temporary and limited downturn.