Diageo: 5-Year Low after Better H1 FY25, Likely Too Pessimistic

Company Update (DGE LN) (Buy): Sales were stable in most regions outside China; tariff risks are centred around Mexico and manageable.

Highlights

Group and U.S. organic sales growth have both turned positive.

Diageo provided evidence why U.S. Spirits downturn is cyclical.

Long-term drivers are intact, and shares on ~15.7x CY24 EPS.

Tariff risks are centred around U.S. Mexican imports and manageable.

At 2,133.0p, we see a 74% total return (18.8% p.a.) by June 2028. Buy.

Introduction

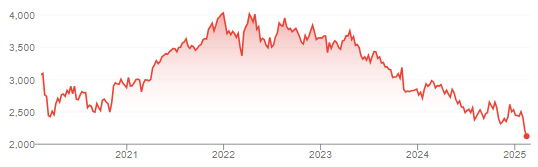

We review our Buy rating on Diageo after the release of H1 FY25 (July-December 2024) results last week (February 4); Diageo shares in London have fallen by 9.8% since then, to a new 5-year low that’s ~13% lower than its COVID trough:

Diageo Share Price (Last 5 Years)

Source: Google Finance (12-Feb-25).

(Diageo American Depository Receipts have fallen by 8.9% in dollars since February 4 and are also lower than in 2020.)

We originally initiated our Buy rating on Diageo in July 2019, placed it into our “Select 15” model portfolio at the start of 2023, and added to it over time until it became a large holding as of September 2024. We have been wrong so far, with Diageo showing a 26% loss (in dollars; 25% in pounds) in the model portfolio, and a similar loss in real life.

We view the current level of pessimism as unjustified. Organic sales growth has turned positive in H1 FY25, adding to evidence that the current downturn is merely cyclical. We believe shares are at ~16.5x trough (FY25) EPS. New U.S. tariffs represent a risk, but a manageable one centred mostly around Mexican imports into the U.S.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)