British American Tobacco: Patient is “Stable” in Pre-Close Update

Company Update (BATS LN) (Buy): No real improvement since H1 results and challenges remain, but an 8% Dividend Yield gives some margin of safety.

Highlights

Undemanding 2024 guidance reiterated; H2 acceleration on weak H1.

U.S. cigarette industry volume decline was largely unchanged at ~9%.

BAT share flat/down in U.S. Vapour, Heated Tobacco, U.S. Modern Oral.

This is a “value” stock where ~8x P/E and ~8% are the investment case.

At 2,985.0p, we see a 49% total return (16.2% p.a.) by end of 2027. Buy.

Introduction

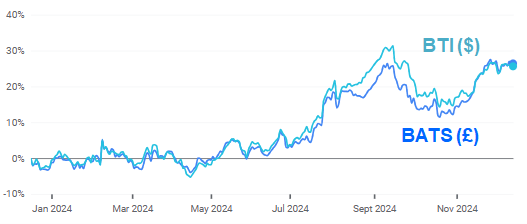

British American Tobacco ("BAT") released its 2024 pre-close update on Wednesday (December 11). BAT shares have been flattish since the update, which means they have risen by ~26% (in both Pounds and Dollars) in the past year:

BAT Share Price Performance (Last 1 Year)

Source: Google Finance (14-Dec-24).

We follow BAT closely because it has been a small position in our “Select 15” model portfolio since September 2023 and more importantly, because it competes with Philip Morris, part of our model portfolio since inception and a top-5 position since September 2023. We originally upgraded our rating on BAT to Buy in March 2020.

The pre-close update also provided insights on the global nicotine industry beyond the Q3 results released by Altria and Philip Morris. (Imperial Brands’ FY24 results also only cover the period up to September 30.)

Unfortunately there has been little improvement in BAT’s businesses since H1 results, with U.S. cigarette volumes still facing strong cannibalization by illicit Vapour. BAT remains a “value” stock where an 8x P/E and an 8% Dividend Yield are the investment case, with further upside should things not turn out as badly as the market seems to fear.

(The rest of this article is for paid subscribers only, but unlocking it costs just $10; you can see a free sample of our research here.)