Ulta Beauty: On the Wrong Side of a Capital Cycle

Initiation of Coverage (ULTA US) (Neutral): We review this Q2 Berkshire Hathaway investment ahead of next week’s investor day; shares are back to 2022 levels.

Highlights

Retailers are typically weak businesses and Ulta is not one of the exceptions.

Ulta is losing sales and share, and likely on the wrong side of a capital cycle.

Competitors are opening new stores; high-end brands are launching on Amazon.

Share gains slowing before COVD; margins may fall again after FY24/25.

At $358.96, P/E is ~16x, but cash conversion may remain mediocre. Avoid.

Introduction

We take an initial look at Ulta Beauty ahead of its investor day scheduled next Wednesday (October 16).

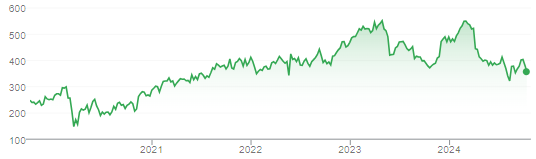

Ulta shares are back at levels seen in 2022, having fallen by 8.7% in the past year; shares hit a 52-week low of ~$318 in August, before a 13-F filing revealed Berkshire Hathaway bought 690k shares (worth ~$250m now) during Q2:

Ulta Beauty Share Price (Last 5 Years)

Source: Google Finance (10-Oct-24).

We believe Ulta operates in a structurally difficult sector at the point in the capital cycle where supply growth has over-shot. Future earnings growth is uncertain, and valuation is not as attractive as its ~16x current P/E suggests.

(The rest of this article is for paid subscribers only, but costs just $10 to unlock; a free sample of our research is here.)