Altria: Gradually, Then Suddenly? Downgrade to Neutral After Declines Continued in Q1

Company Update (MO US) (Downgrade to Neutral): We believe cigarette volume risks now outweigh Altria’s superficially attractive 8.7x P/E and 9.0% Dividend Yield.

Note: Alphabet and Microsoft were #1 and #3 of our “Select 15” model portfolio at ~11% each, but their results this evening were self-evidently good, so we believe we can add more value by writing about Altria first.

“How did you go bankrupt?" “Two ways. Gradually, then suddenly.”

- Ernest Hemingway, “The Sun Also Rises” (1926)

Highlights

Altria revenues, operating income and EPS all fell year-on-year in Q1.

Cigarette volume again fell by 10%; Oral Tobacco grew modestly with on!

NJOY shipments fell sequentially, and the FDA remains ineffectual in e-vapor.

IQOS will start trials in the US in May, and can launch at scale in 2025.

At $43.54, P/E is 8.7x and Dividend Yield is 9.0%, but there is a risk of loss.

Introduction

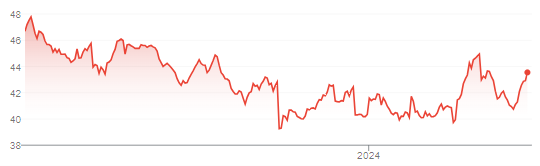

Altria reported Q1 2024 results this morning (April 25). Shares finished the day up 1.4%, but are down 6.8% in the past year:

Altria Share Price (Last 1 Year)

Source: Google Finance (25-Apr-24).

We originally upgraded our rating on Altria to Buy in February 2020, and built a substantial position in the stock in the following months. While we subsequently exited our position in February 2022 (with a 47% total gain), we had maintained our Buy rating on Altria until now. This had largely been based on valuation, which had hitherto offset our increasing conviction that the Tobacco industry has begun a structural shift towards Reduced Risk Products (RRPs). Our top pick in Tobacco has been Philip Morris, with its huge lead in both Heated Tobacco and U.S. Nicotine Pouches, and conversely we have rising concerns about Altria’s lack of success in RRPs. We became even more alarmed when Altria abruptly increased their estimates on the U.S. E-Vapor market at Q3 2023 results, and explicitly stated in our review of Altria’s Q4 2023 results that the Tobacco earnings algorithm has broken down in the U.S. market, and needs to be rescued by government intervention in the form of an effective FDA crackdown on illicit e-vapor disposables.

We are downgrading our rating on Altria to Neutral because time is now running out for the company to build a sufficiently strong RRP market share to offset the upcoming threat from IQOS launching and ZYN continuing to grow in the U.S., and the so far gradual declines in Altria’s earnings may suddenly accelerate in the coming years.

(Our paid tier costs just $10, or less than ¼ the price of a single Altria share.)