Xero Limited released its FY21 (ending 31 March) results this morning. Shares closed down 13% in Sydney for the day, which means they are down 26% from their 52-week high in December. We do not cover Xero directly but track its developments for Intuit (Buy-rated) and Sage Group (Neutral-rated) in our coverage.

A Year of Two Halves Due to COVID-19

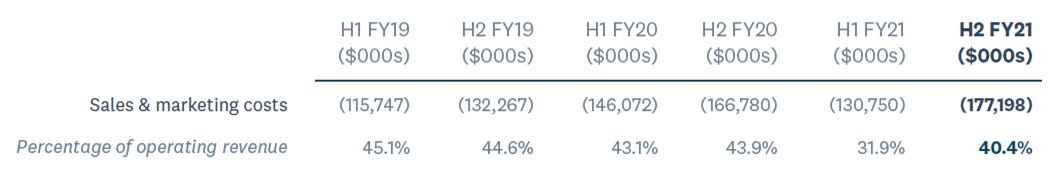

FY21 was a year of two halves, with H1 affected by COVID-19 and Xero intentionally reducing sales and marketing costs for that period, increasing them again in H2:

As a result, Xero’s subscriber net additions were notably lower in International markets during H1 FY21, before picking up again in H2. Churn also fell significantly in H2 FY21, which helped make it a record half-year in net additions for the group: