Tesco: Revisiting this Classic Value Stock after FY23 Results

(Substack Exclusive) Company Update (TSCO LN) (Downgrade to Neutral)

Introduction

We review Tesco PLC, the #1 U.K. grocery chain by sales, after FY23 results were released on Thursday (April 13).

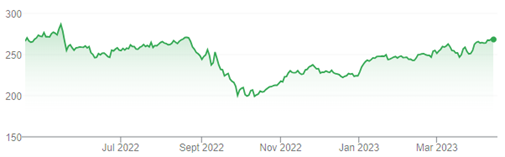

Tesco Share Price (Last 1 Year)

Source: Google Finance (14-Apr-23).

We wrote about Tesco as a “classic value stock” as part of our content on Seeking Alpha last October and assigned it a Buy rating. As of Thursday close, shares have gained 38.3% (including dividends) since our article.

Tesco reported a flat Adjusted EPS in FY23. However, this benefited from buybacks and other non-operational items, and Adjusted EBIT fell 6.9% year-on-year, largely due to a decline in the U.K. & Ireland business. While Tesco remains the strongest player in U.K. groceries, they are not immune to macro pressures, and their Adjusted EBIT margin fell significantly. For FY24, Tesco is guiding to a “broadly stable” Adjusted EBIT, but a higher U.K. tax rate will hit EPS. Tesco earnings will likely be stable with benign macro, but upside is also likely limited. Shares are on 12.5x FY23 EPS…