Rightmove: 2023 Results & 2024 Guidance are a Marshmallow Test

Company Update (RMV LN) (Buy) EPS growth has fallen to around 6%, but a return to ~10% growth is likely if you can wait past 2024, and shares are cheap at 21.9x P/E.

(This article is for paid subscribers, but it costs only $10 to become one; we also offer free trials to professional/educational e-mail addresses – hit “reply” or write to us here.)

Highlights

Step-up in investments and higher tax rate reduced EPS growth.

But core revenue growth was 9.5%; new areas grew even more.

Cost margin to peak in 2024; marketing spend not rising despite CoStar.

Shares cheap at 21.9x 2023 EPS, EPS growth likely ~10% from 2025.

At 550p, we see a 50% total return (15.7% p.a.) by 2026 year-end.

Introduction

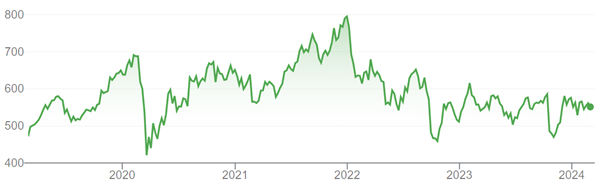

Rightmove released 2023 results this morning (March 1); shares fell by nearly 5% in the first hour of trading, but has recovered to about 2.5% down (or ~550p) as of 14:15 U.K. time.

Rightmove Share Price (Last 5 Years)

Source: Google Finance (01-Mar-24).

We upgraded our rating on Rightmove to Buy in October 2021, and have added it to our “Select 15” model portfolio in July 2023 (at 520.6p). At current prices, shares show a 15.5% loss since our upgrade but a 6.3% gain in our model portfolio (including dividends). In real life we added significantly to our position in the first hour of trading this morning.