Pernod Ricard: Cyclical Downturn in H1 FY24; Cheap at 24x FY19 EPS

Company Update (RI FP) (Buy): Shares are still below their 2019 level. We believe the downturn is cyclical and see a 44% upside (17% annualized).

(This article is for paid subscribers only, but some future articles will still be e-mailed FREE to everyone on our subscriber list, including monthly updates on our “Select 15” model portfolio.)

Highlights

Net Sales fell 7.4% and Op. Profit fell 11.6% in H1 FY24

However, long-term growth is still solid and H1 had one-offs

Outlook sees a stronger H2; U.S. market is already growing 1-2%

Shares cheap at 23.9x FY19 EPS, though 3.3x Leverage is a risk

At €155.85, we see a 44% total return (17.0% p.a.). Buy

Introduction

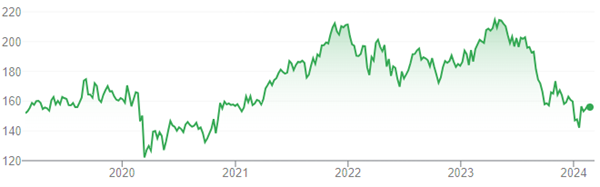

Pernod Ricard (“PR”) reported H1 FY24 (July-December) results last Thursday (February 15). Shares have risen by less than 1% since results, and remain below where they were at the end of 2019, before the COVID-19 pandemic:

Pernod Ricard Share Price (Last 5 Years)

Source: Google Finance (20-Feb-24).