Highlights

Q1 growth reaccelerated to 12% in volume and 10% in revenues

But reacceleration has come from lower-margin sources

Non-Transaction Expenses were down 16% year-on-year

We see the “real” P/E at ~21x and good downside protection

PayPal can double if it returns to 10% growth and 22.5x P/E

Introduction

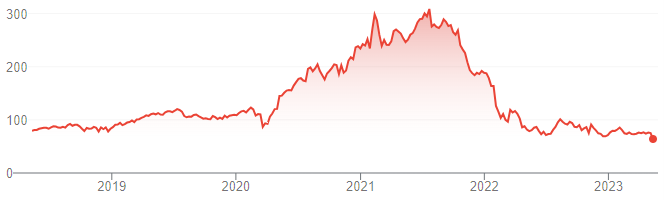

PayPal released Q1 2023 results on Monday (May 8) evening. Shares have fallen another 16% in the subsequent two days, which means they are now 80% below their July 2021 peak and back to their lowest level since 2017:

PayPal Share Price (Last 5 Years)

Source: Google Finance (10-May-23).

PayPal has been a disaster for investors in the past few years. Management attributes the material deceleration in revenue growth to a slowdown in e-commerce, has committed to correcting some mis-steps in their strategy, and has been implementing significant cost reductions since 2022.

Q1 2023 showed stability and early signs of improvement. Volume and revenues reaccelerated modestly, but from sources with inf…