Summary

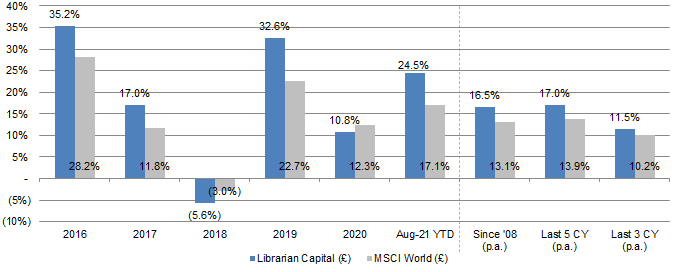

Our long-only portfolio gained 4.1% in GBP in August, 0.6 ppt ahead of MSCI World; year-to-date, it has gained 24.5% in GBP, 7.4 ppt ahead

The portfolio is now up 82.9% since 2019, more than 20 ppt ahead of MSCI World, and is ahead of other indices and leading “quality” funds

Top August contributors were Charter, Microsoft, Facebook, BofA, Intuit; top detractors were Mastercard, Visa, Raytheon, Unilever, Altice USA

We initiated a new position in Altice USA, and added to our Mastercard, Visa and Alphabet holdings, partly funded by reducing our stake in Intuit

At month end the portfolio held 21 stocks, with 70% of its value in the top 10; 13 stocks were in 5 investment themes; cash was at 1.4% (down from 3.7%)

Portfolio Performance

Our long-only “Librarian Capital” portfolio gained 4.1% in GBP in August, 0.6 ppt ahead of our chosen benchmark MSCI World, which gained 3.5%. Year-to-date, our portfolio has gained 24.5% in GBP, 7.4 ppt ahead of MSCI World’s gain of 17.1%:

Currency was a ta…