American Express (AXP) released its Q1 2021 results this morning. Shares are currently down 4.8% in pre-market trading. Highlights of the results are below.

Volume Recovery Accelerated in March

AXP’s billed business volume has continued to recover, accelerating in March, albeit still partly dragged down by Travel & Entertainment (“T&E”).

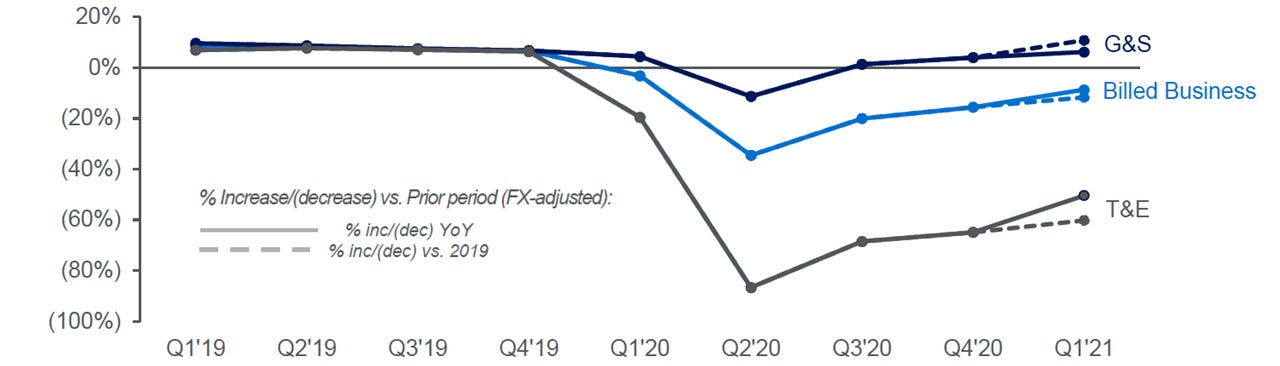

For Q1 2021, total billed business remained 9% lower year-on-year (and 12% lower than in 2019), with T&E being 50% lower year-on-year. Goods & Services (“G&S”) billed business year-on-year growth was already positive in Q4 2020 and accelerated further in Q1, at 6% higher year-on-year (and 11% higher than in 2019):

AXP Total Billed Business Growth Y/Y (Since Q1 2019)

Q1 2020 saw significant disruption from COVID-19 in China from mid-February, and from Europe from early March, which distorted some of the year-on-year comparison. However, even when compared with 2019 volumes (see the dotted line above), the continuing volume recovery is still clearly visible.